How to complete a tax return in Luxembourg

In this guide, let's look at the intricacies and peculiarities of completing a tax return.

A tax return is the main document that records an individual's income and the tax burden due. It also serves to indicate the deductions due. Filling in a tax return is a responsible process, so if you are not confident in your own abilities, it is better to contact specialists.

You can complete the declaration either on paper or electronically. If you choose to complete the document online on the Guichet website, you will need to identify yourself. The site will also ask you for an electronic signature to certify the declaration. Otherwise, there are no differences, except that filling it out online gives you the right to make mistakes and corrections.

How to order and use LuxTrust in Luxembourg

Those who have already encountered filling out a declaration recommend doing it online or in a downloaded PDF document. This will allow, as mentioned above, to correct errors if they occur..

Filling in the application form online offers another advantage - an electronic assistant that will provide tips on calculations and the basics of filling in the form. To access it, you need to log in to the MyGuichet portal in any of the following ways:

- With the Luxtrust certificate.

- With GouvID and mobile app.

- With eIDAS. However, please note that eIDAS does not allow electronic signature if it is issued by another country.

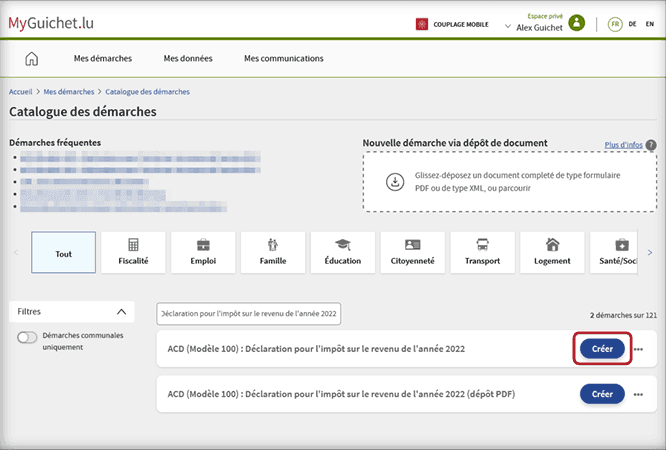

Create a declaration

To start filling in the document, it must first be created. To do this, click on the "Creer" button marked on the screenshot.

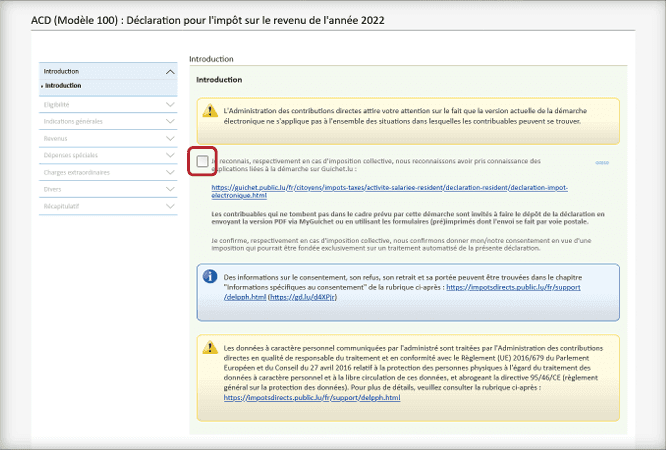

Give your consent to the work of the e-assistant

To do this, tick the appropriate box and click on the "Continuer" button below on the same page.

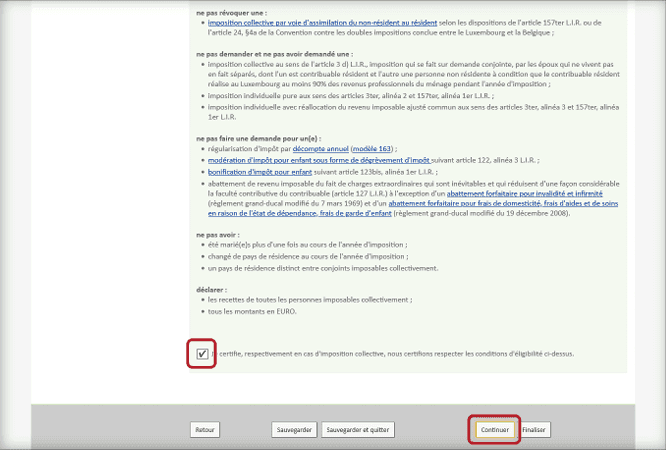

Accept the terms of service

One more important step before you start filling in the declaration. This page contains the most comprehensive list of legal provisions and links to more detailed documents. We recommend using a translator if you do not know French very well.

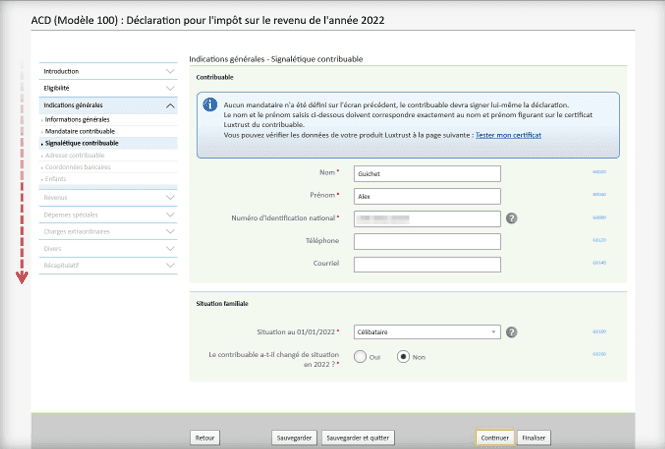

Proceed to fill out

Now comes the most important part. Unfortunately, it is not possible to give clear instructions for this part: filling in the tax return is individual for each applicant. Use the services of an assistant — he or she will give you useful recommendations and explain what field is required for what purpose.

Luxtoday readers in an interview about taxes

This is a pretty important point. There is a clarifying question at one of the initial points on the Guichet declaration that asks you to enter the number of people who are making the application.

If you are filing for yourself

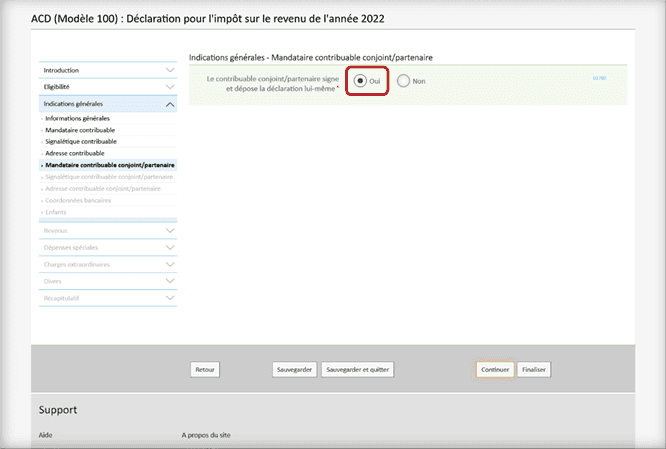

This means that there will be one signature and one authorised user in the system. In this case, select the following settings:

When asked if you are applying for yourself, you should obviously select "Yes" ("Oui"). That's it, you can move on to the next step.

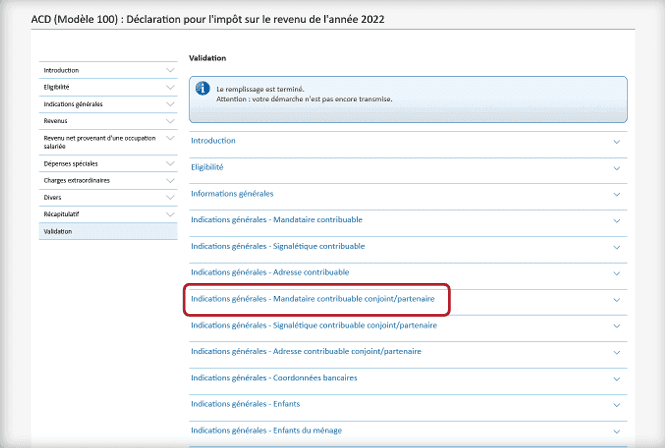

If you are filing a collective declaration

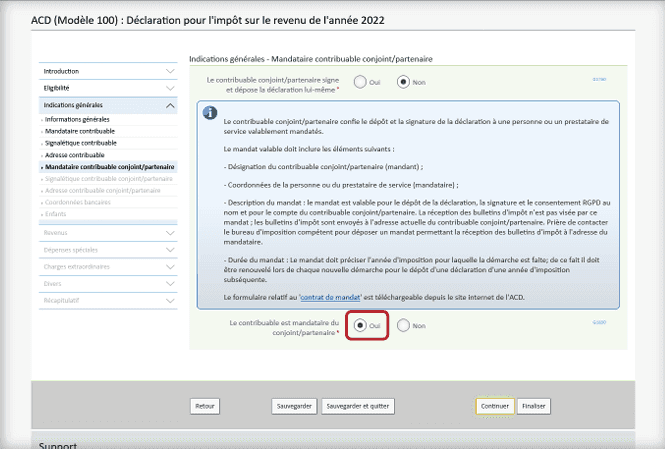

This happens when, for example, two spouses have a common budget and pay taxes on the whole amount of their income, rather than each paying taxes individually. In this case, you should select other settings:

In the first item, check the "Non" box. You will see an expanded window with another question: "Is the taxpayer a fiduciary of a spouse/partner?

If each spouse uses a personal electronic signature tool, the box "Non" should be ticked. If one person signs for both partners, the box "Oui" should be ticked.

When filing a joint return for both spouses, you will need to attach an assignment agreement to the completed form. This can be downloaded from the Administration for Direct Contributions (ACD) website. You will need Form 101F.

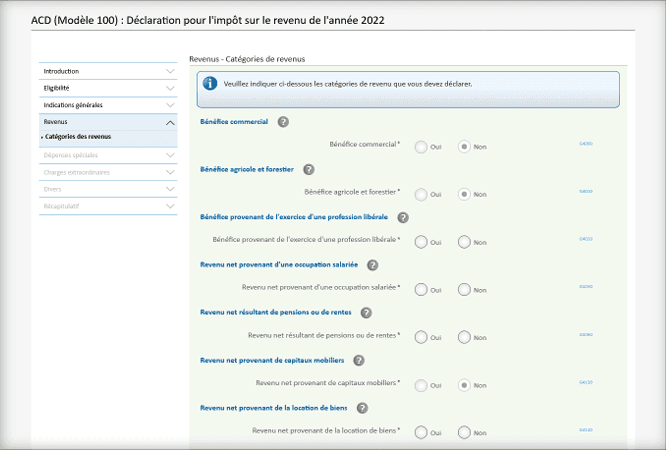

From this point on, you will have to familiarise yourself with the main fields of the tax return and fill them in. This is quite a non-trivial task for the first time or even two, as there is no standardised instruction on how to do it correctly.

The reason is simple — as we wrote above, each person's income parameters are different. Therefore, categories that apply to you may not make sense for other applicants and vice versa.

There are two working ways to make the declaration easier to complete:

- Contact a professional accountant, who will take over the filling in duties.

- Use online services, e.g. taxx.lu.

A few general recommendations and lifehacks

Don't be afraid to make mistakes

The Guichet declaration allows you to edit fields and even go back to previous pages if you forget to enter some data or want to double-check already filled in lines.

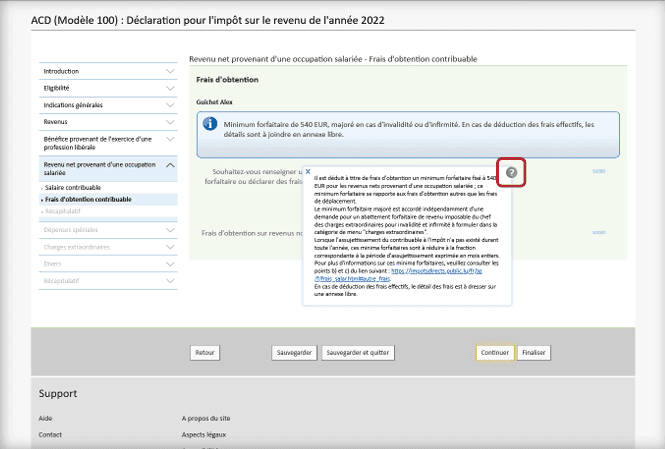

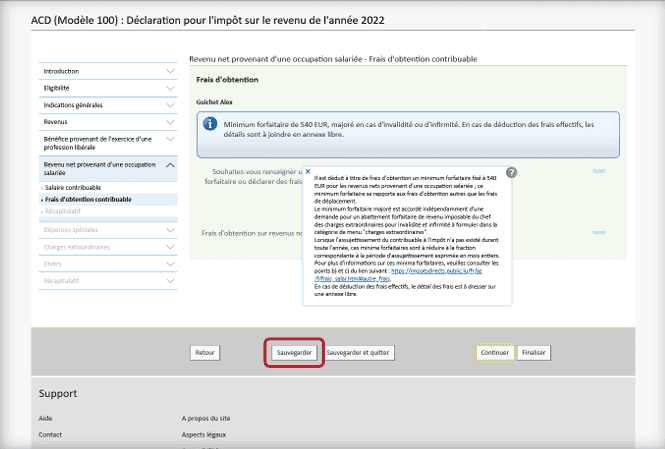

Use hints

Clicking on the question mark next to the line will give you a detailed explanation that can answer most basic questions.

Save more often

You can save the entire filling progress an unlimited number of times using a special button. This comes in handy in case of unstable internet or, for example, a sudden blackout.

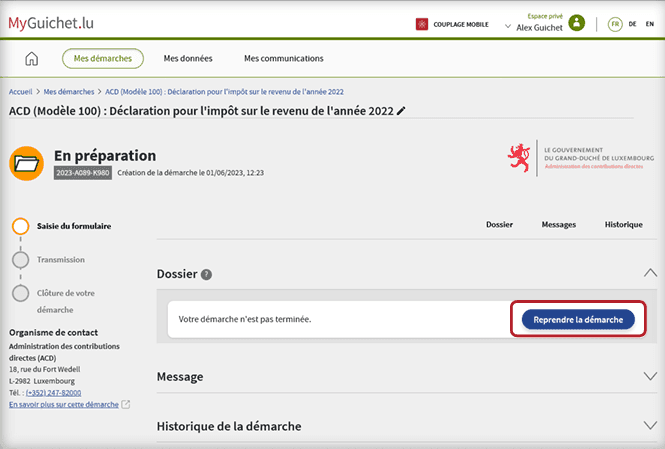

Continue where you left off

If you need to take a break to consult your accountant or do other things, you can always pick up where you left off last time. Of course, this is only if you have saved your work in advance.

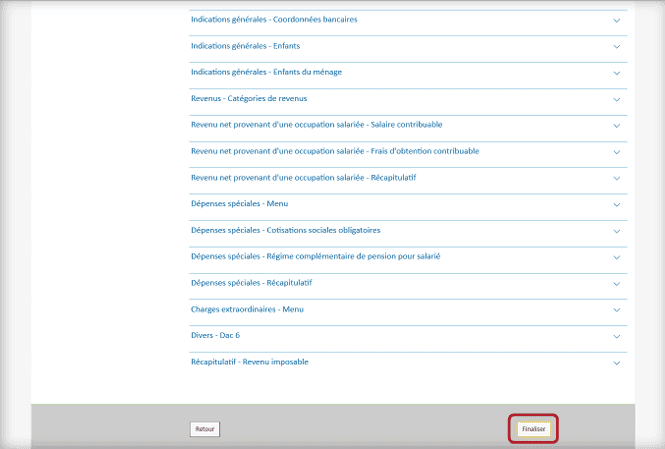

Once you have completed the tax return, you will have to sign it and send it to the authorised authorities. However, the system will thoughtfully display general information about your taxable income on your screen first, and then give you the opportunity to check the accuracy of the specified data once again.

If all data is correct and you have no complaints or corrections, click on the "Finaliser" button. This will save the finalised declaration and take you to the signature page.

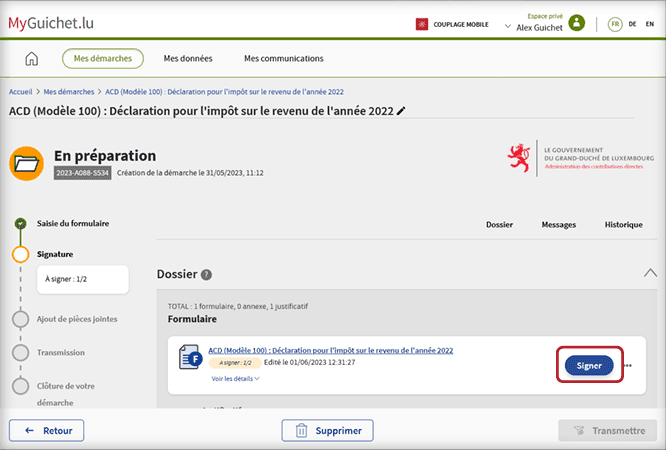

Signing a tax return is a quick but extremely responsible process. It is an indication that the taxpayer confirms that the information entered is accurate.

There are two ways to sign the declaration on the Guichet website:

Note that eIDAS allows you to authorise yourself in the system but does not allow you to sign the declaration!

Once you have selected your signing method, simply follow the on-screen instructions until you are in your personal Guichet space.

Joint taxation

If the spouses are filing a joint return, they must both sign the document. To sign the second signature, click on the "Signer" button and then the second partner must go through the same signing steps as the first one.

If the system shows an error, it means that you are using the same ID for signing, but did not specify this in step #3.

To correct the situation is very simple. It is enough to press three dots near the "Signer" button, select the "Editer" item and then select the item indicated on the screenshot and edit the parameters.

After that, all that remains is to finalise the signing of the declaration. Please also note that if the signing was done by one spouse from the same instrument, an assignment agreement will appear in the list of mandatory attachments. It can be attached here as well, if you have not done so before.

One of the final stages of tax return preparation is the documents. This is where all supporting certificates/receipts/cheques/contracts and any other evidence of the movement of funds or papers entitling you to a tax deduction are enclosed.

How to get a tax deduction in Luxembourg

Adding documents is a fairly simple process. All you need to do is click on the "Joindre" button in your MyGuichet personal area. Please note that you can upload files either from your computer or from your Guichet account. And in the second case, all documents are automatically converted to PDF format, which is certainly very convenient.

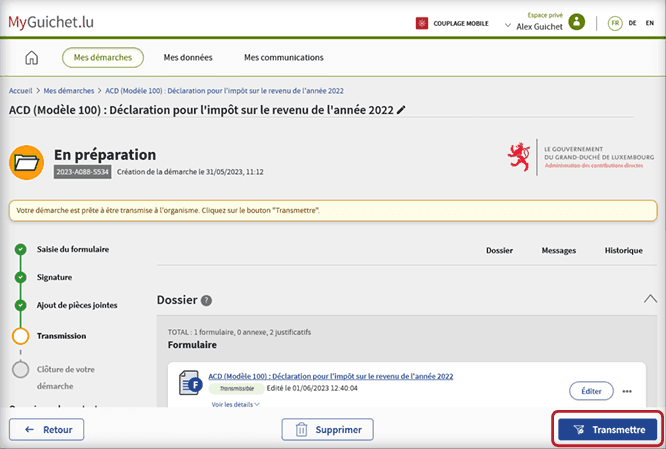

Once all the preparations are complete, the only thing left to do is to send the completed document to the tax office. The Guichet portal will also help with this.

To complete the filling procedure, click on the "Transmettre" button and follow the on-screen instructions

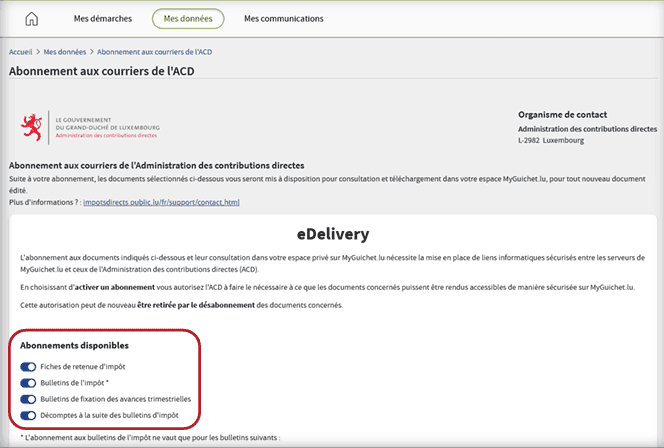

Upon receipt of the return, the IRS will process the data and send you a response letter indicating the total amount of tax payable and the amount of deductions you are entitled to.

You can receive the letter via the MyGuichet portal if you have set up the receipt in your personal account.

It may also come in the regular mail. Once you receive the letter, you have the right to appeal the decision within 90 days. Please note that in case of an error, the data will be rechecked and the result may change both in your favour and in favour of the state!

Frequently Asked Questions (FAQ)

Whether it is compulsory to fill in a tax return?

Is it difficult to fill in the declaration yourself?

Source: guichet.public.lu

We took photos from these sources: Ibrahim Boran at Unsplash