Changes in tax scale presented to the public

Finance Minister Gilles Roth has presented an update on the tax scale to the parliamentary finance committee. This reform aims to mitigate inflationary effects after several rounds of indexation.

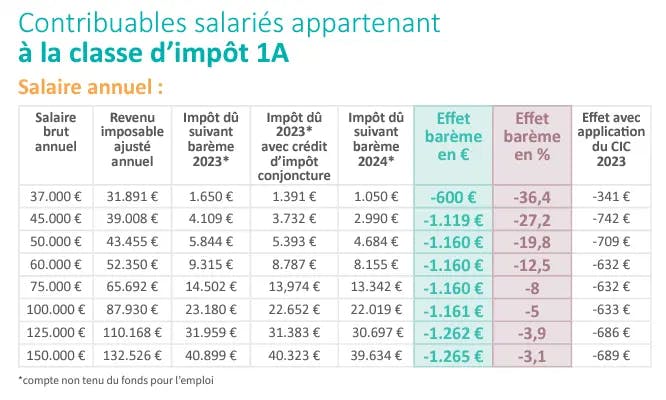

Although the calculations appear complex at first glance, a closer look at the examples shows that the tax burden will be reduced for all classes. The rates remain the same, but the brackets to which these rates apply change.

Example:

A Class 1A taxpayer with a salary of 50,000 euros per year will have to pay 5,844 euros in 2023. With the upcoming adjustment, this amount will drop to 5,393 euros, and when the new rules are fully implemented in 2024, it will be only 4,684 euros. This literally means that a person will receive 1,160 euros more per year.

The percentage changes are distributed as follows: the greatest benefit goes to low-income people in each tax bracket. The higher the wealth, the lower the overall percentage of savings. However, the sheer amount of savings increases proportionally, which is to be expected.

For example, a Class 1 taxpayer with an income of 37,000 euros would benefit from the scale change by 448 euros per year or 14.7% of the current tax amount. At the same time, a person with an income of 150,000 euros would save 1,198 euros, but as a percentage, it would be only 2.9%.