Financial storm: US trade policy crashes markets but strengthens Luxembourg

Andy Quezada, Unsplash

In April 2025, a new wave of financial turbulence swept the world. The announcement of a massive "America First" duty hike by the US President triggered panic in the markets. The VIX volatility index, known as the "fear barometer," reached pandemic levels. Stocks, bonds and currencies are frantic around the world.

Against this background, the euro zone has shown resilience. The European Euro Stoxx 50 index has risen by 5.6 per cent since the beginning of the year, while the S&P 500 in the US has fallen by 6 per cent and Japan's Nikkei 225 by 10 per cent. This can be explained by a temporary "respite" in the trade standoff and a reallocation of assets towards more stable European jurisdictions.

Luxembourg has already felt the direct benefit of the loss of confidence in US assets. In the first quarter, funds registered in the country recorded record net inflows of €60bn - the best performance in four years. With confidence in the dollar falling, investors are looking for safe jurisdictions and Luxembourg stands to benefit from this reallocation. If outflows affect exchange-traded funds (ETFs) based in Ireland, Luxembourg could strengthen its position as a key asset management centre in the EU.

In addition, the ECB's key rate cuts will stimulate credit growth, which will also support economic activity and the value added of the country's financial sector.

After the announcement of the duties, oil prices went down sharply: Brent fell 14% in dollars and 18% in euros, due to the strengthening of the latter. Within Luxembourg, this has already had an impact on fuel prices: heating oil fell in price by 8.9%, diesel by 5.7% and Super 95 petrol by 5%. As a consequence, inflation fell to 1.7% in April, but this was enough to trigger an automatic indexation mechanism from 1 May: wages, pensions and benefits will increase by 2.5%.

Employment growth in the country remains modest at around 1 per cent year-on-year. The private non-financial sector, where almost three quarters of all new jobs were created before the pandemic, is recovering particularly slowly. The construction industry, which had previously experienced the biggest downturn, is showing signs of recovery. The unemployment rate has stabilised at 5.9 per cent.

Residential property prices in Luxembourg have started to grow moderately. Q4 2024 recorded a quarterly increase of 1.1 per cent and an annualised increase of 1.4 per cent, the first increase since the end of 2022. However, prices are still 15% below peak levels. New buildings are holding steady, while more tangible growth is being seen in other eurozone countries - such as Spain and the Netherlands, where prices have risen by more than 10% over the year.

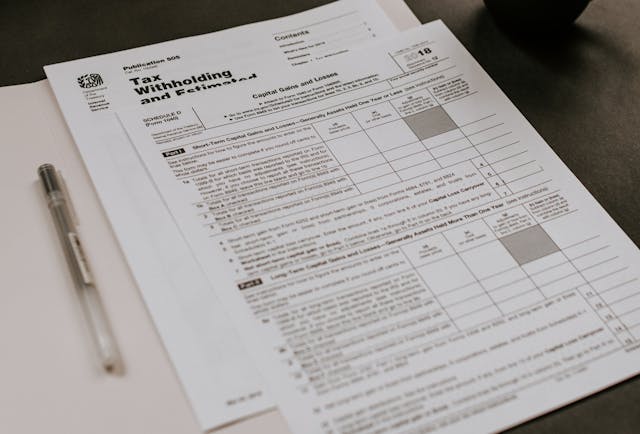

Corporate income taxes increased by 50 per cent year-on-year and by 40 per cent quarter-on-quarter, which is explained by the receipt of payments for previous periods. At the same time, personal income tax revenues fell by 5.5%, also due to adjustments in tax scales. Excise taxes on tobacco increased by 7%, while fuel and registration went down.