Luxembourg, aiming to boost national competitiveness, has strategically focused on attracting international talent. Central to this effort is the Impatriate Tax Regime, a fiscal policy specifically designed to help local businesses recruit top-tier professionals from around the world. This regime, first introduced in 2011, has undergone several legislative refinements. The latest version, codified under Article 115, Section 13, Letter b) of the Income Tax Law, became effective on January 1, 2021.

Work-related immigration in Luxembourg

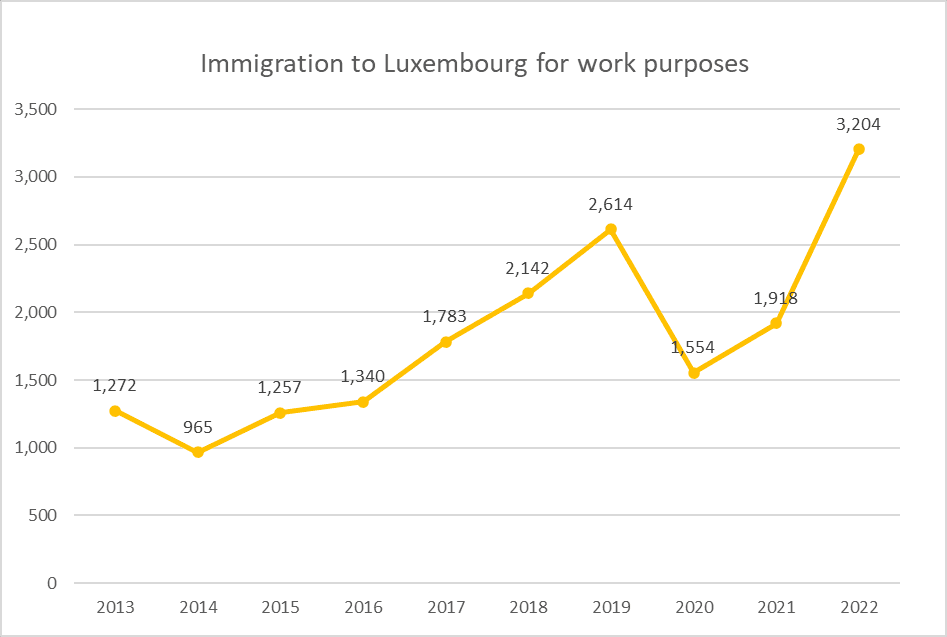

Luxembourg stands as an alluring destination, drawing individuals with its elevated quality of life and competitive salaries. In 2022 alone, 3,204 people migrated to Luxembourg for work-related reasons, showcasing a consistent upward trend over the past decade, except for 2020, where the COVID crisis led to a temporary dip in immigration.

This thriving influx comprises highly skilled professionals, a cohort eligible to leverage the impatriate tax regime. In the upcoming section, we will dig deeper into the specific criteria that define who can benefit from this tax regime, exploring the facets that make Luxembourg an increasingly favored hub for skilled workers seeking both professional opportunities and financial advantages through the impatriate tax regime.

Who can benefit

Not all workers can avail themselves of the Impatriate Tax Regime; it is exclusively designed for individuals classified as "impatriates" under Luxembourgish law. This category encompasses:

- Employees dispatched by a foreign company within an international group to work in Luxembourg, benefiting a Luxembourgish company within the same international group.

- Individuals hired from abroad by a Luxembourgish entity or a company established in another European Economic Area member state to work within said company.

What conditions must be met by the employee and the employer

Being classified as an impatriate is just the first step; both employees and their hiring companies must meet specific requirements. In the upcoming section, we'll explore the essential conditions that both individuals and employers must fulfill to qualify for Luxembourg's impatriate tax regime.

Employees opting for the Impatriate Tax Regime must meet specific criteria, including:

- Making a significant economic contribution or contributing to the creation of new high-value economic activities in Luxembourg.

- Being a Luxembourg tax resident.

- Not having been a Luxembourg tax resident or subject to income tax in Luxembourg for the five years preceding the employment in Luxembourg and not having lived within 150 kilometers of the Luxembourg border.

- Possessing in-depth technical expertise or a minimum of 5 years of specialized work experience in the sector for which the local company requires the employee, or in the sector, the local company plans to develop in Luxembourg.

Additionally, specific conditions apply for intra-group transferees:

- Five years of seniority within the international group or five years of specialized professional experience in the corresponding sector.

- An existing working relationship between the entity in the originating group and the transferred employee during the assignment.

- Impatriates must have the right to return to the foreign entity after completing the assignment.

- A contract regarding the employee's assignment must be established between the sending company and the local company in Luxembourg.

For employees hired abroad

Highly or specifically skilled foreign hires must demonstrate expertise in a sector or profession with a shortage of qualified candidates in Luxembourg.

For employers, a crucial criterion is that only 30% of the company's full-time workforce can avail themselves of the Impatriate Tax Regime. Notably, this requirement is exempt for companies established in Luxembourg for less than 10 years. Understanding and adhering to these parameters is essential for employers navigating Luxembourg's Impatriate Tax Regime, ensuring compliance and optimal utilization of the benefits offered.

What characteristics must the job meet

In addition to employee and employer conditions, specific job-related criteria shape eligibility for the Impatriate Tax Regime. The employee must:

- Be employed for a job that is their main professional occupation.

- Earn an annual fixed salary in Luxembourg of at least 100,000 euros gross.

- Apply specialized knowledge and expertise for the benefit of the company's workforce.

Crucially, individuals seeking this regime cannot replace other employees outside the scope of this fiscal framework.

What are the benefits of the impatriate tax regime

Highly qualified employees who meet the aforementioned conditions may benefit from the tax regime for taxpayers for a maximum period of 8 years.

The benefits provided by this regime are, however, in the midst of change, the Chamber approved a new regime of Deputies on December 11, 2024 and came into force on January 1, 2025. Those who benefit from the regime in its version applicable until fiscal year 2024 will continue to be subject to the same regime in its version applicable until fiscal year 2024 for the following fiscal years provided that the relevant conditions continue to be met. However, those currently benefiting from this regime may expressly request the tax administration that the new regime be applied as of tax year 2025.

Since the previous regime will continue to be for tax year 2024 and thereafter for those who do not opt for the change, we will present both the old regime and the new one.

Benefits of the regime applicable until tax year 2024

This regime allows a partial or total tax exemption of expenses in kind or in cash directly linked to expatriation through the possibility of imputing a whole series of employee expenses as operating expenses of the company so that they are not considered income for the employee as long as the amounts do not exceed a reasonable amount. These expenses are listed below:

Non-Recurrent Costs Arising from Relocation:

- Moving expenses to transfer the employee's residence to Luxembourg.

- Travel expenses for the employee, spouse, or partner, and household children, including accommodation costs during the journey.

- Dismantling, packing, loading, transporting, unloading, unpacking, and assembling furniture belonging to the employee or a family member.

- Expenses for transformers or adapters for foreign electrical appliances.

- Housing arrangement costs in Luxembourg, encompassing the purchase of furniture or household appliances such as dishwashers, washing machines, or dryers.

- Travel expenses due to special circumstances like childbirth, marriage, or the death of a family member.

- Final return expenses to the home country at the end of the employee's assignment, including the costs incurred for moving.

Recurring Expenses Resulting from the Move:

Depending on the type of expenses, there are specific limits for them to fall within the framework of this regime.

These expenses must not exceed 50,000 euros annually, nor 80,000 euros if the worker shares residency with a spouse or partner, nor 30% of the total annual fixed remuneration of the worker.

- Eligible housing expenses include rent, heating, gas, electricity, water, elevator fees, taxes, and related taxes. If the employee does not maintain their former habitual residence in their home country, eligible expenses only include the differential housing cost.

- Annual travel expenses between Luxembourg and the home country for the employee, spouse or partner, and household children.

- Expenses related to tax equalization of native taxes to compensate for the tax burden difference between Luxembourg and the home country ("tax equalization").

An additional flat-rate bonus paid by the employer to an impatriate due to the cost-of-living differential between the host country and the home country. The bonus is subject to the condition that 50% does not exceed 30% of the gross annual remuneration before incorporating cash and in-kind benefits, as well as other miscellaneous moving-related expenses not mentioned under recurring and non-recurring expense criteria.

Additional school fees for the education of the employee's or their spouse or partner's children.

New regime applicable as of January 1, 2025

In order to make Luxembourg more attractive for talent and highly specialized profiles, the government, taking into account the attractive regimes in place in other EU countries has carried out a complete overhaul of the tax regime for impatriates.

The various current tax benefits such as moving expenses, housing expenses and the impatriation bonus are removed and replaced by a flat-rate exemption of 50% of gross annual remuneration, excluding partially or wholly exempt payments such as participation bonuses or interest subsidies, as well as benefits in kind. This exemption would apply up to a maximum limit of 400,000 euros of gross annual remuneration.

The impatriate tax regime thus provides a comprehensive framework for relieving qualified employees and their employers from a significant portion of the financial burdens associated with international assignments. By incorporating these benefits, Luxembourg not only incentivizes the influx of skilled professionals but also fosters an environment conducive to economic growth and cross-border talent exchange.

Frequently Asked Questions (FAQ)

What benefits does the impatriate tax regime bring to employees in Luxembourg?

The impatriate tax regime offers significant financial advantages to employees. It provides a partial or total tax exemption for expenses related to relocation, including housing, travel, and tax equalization compensation. By reducing the tax burden on specific costs, employees experience increased take-home pay and enhanced financial flexibility during their assignment in Luxembourg.

What is the maximum duration an employee can benefit from the impatriate tax regime?

Employees meeting the criteria can enjoy the benefits of the impatriate tax regime for a maximum period of eight years. This duration allows for a substantial timeframe during which highly qualified individuals can leverage the fiscal advantages associated with the program.

Who qualifies as a highly qualified employee under the impatriate tax regime?

Is there a minimum annual salary requirement for employees to qualify for the impatriate tax regime?

Yes, employees must have a fixed annual salary in Luxembourg of at least 100,000 euros gross to qualify for the impatriate tax regime. This financial threshold ensures that individuals benefiting from the regime are contributing significantly to the economy and receiving a competitive compensation package during their assignment in Luxembourg.

Source: globalcompliancenews.com, guichet.public.lu, guichet.public.lu, gouvernement.lu, mfin.gouvernement.lu, legilux.public.lu, wdocs-pub.chd.lu, www.chd.lu, omnitrust.lu, www.arendt.com, lu.andersen.com, www.gpme.lu, www.aoshearman.com, maples.com

We took photos from these sources: Volkan Olmez for Unsplash, Eurostat