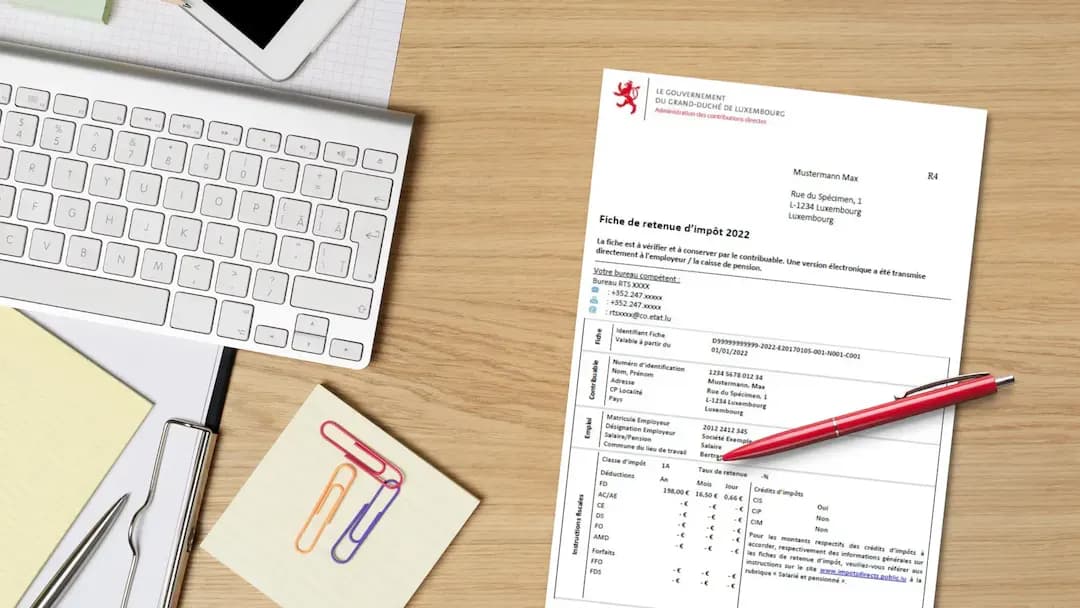

Luxembourg is known for its favorable tax system and the presence of numerous multinational corporations. One of the key features of the country's tax system is the Luxembourg tax card, which serves as an important document for both residents and non-residents working in Luxembourg. The tax card provides crucial information about an individual's tax status, including their tax class and available deductions.

What is a Luxembourg tax card

The Luxembourg tax card, also known as a «fiche de retenue d'impôt», is a document issued by the tax authorities that serves as proof of an individual's tax status in the country. When an employer pays their employees' wages, they are required to withhold income tax at the source.

This means that the employer is responsible for deducting and dispatching the appropriate income tax on the employee’s behalf. To facilitate this process, employers use tax cards of their employees, which contain information about tax classes and indicate the applicable withholdings rate.

Without a tax card, the employer will withhold income tax at the highest tax rate — class 1. The typical tax rate for the case cannot be lower than 33% which may result in you paying more taxes than necessary.

This is why having a tax card is essential to ensure that the appropriate amount of income tax is withheld so there is no over- or under-taxation. Therefore you will need to obtain your tax card as soon as you arrive in Luxembourg and begin to work here.

Types of tax cards

There are different types of tax cards. Until April 30th, 2021, the Luxembourg Inland Revenue (ACD) issued tax cards that were only valid for one tax year. However, starting in May of 2021, the ACD introduced electronic multi-year tax cards, which are valid for several years, unless the card owner needs to make some changes to the information on the card. We will cover these situations further.

Annual

Multiannual

Who needs a tax card

In the Grand Duchy, all employees working for a resident employer and subject to taxation must obtain a tax card. However, there are some exceptions and the following categories do not need a tax card:

- Individuals who receive a salary or pension that is not taxable in Luxembourg according to domestic law or international agreements;

- Pupils and students hired for occasional work during school holidays, whose net hourly pay after tax and social contributions does not exceed 16 euros;

- Private household employees hired for housekeeping or childcare, or to provide support and care to dependent individuals;

- Temporary agency workers (interim workers), whose salaries are subject to a flat tax on income of 10%, except for those with a gross hourly wage over 25 euros.

How to obtain a tax card in Luxembourg: step-by-step guide

Depending on whether you are a resident of Luxembourg or an expat (non-resident) and whether this is your first or subsequent application for a tax card, the administrative procedure that applies to you will differ. In this section, you will be able to see the possible scenarios and guide on how to obtain the tax card for yourself.

How to obtain a tax card in Luxembourg as a non-resident

To get a tax card as a non-resident employee, for example, when you start work in Luxembourg for the first time, you must request a non-resident tax card at the RTS Non-Residents office.

To do so, you need to provide the documents:

- The Form 164 NR fully filled out with personal information like your name, address, date of birth, and nationality along with your income and employment status

- A residence certificate (a copy of the electricity or gas bill will work as proof of residency);

- Documents supporting your civil status — depending on the situation, you should bring a marriage certificate, a copy of the separation order, or a copy of the divorce papers, depending on the state of your partnership (any other equivalent document will work too).

That should be enough, but you always might be asked to provide additional documents. Once you have all the documents you should send them by post to the RTS Non-Residents office and normally you will receive your tax card in 30 days.

Address: 21 rue Eugène Ruppert, 2453 Luxembourg, B.P. 1706 L-1017 Luxembourg

How to obtain a tax card in Luxembourg as a resident

To obtain a tax card as a resident and current employee in Luxembourg, you do not need to make a request or take any action. The competent RTS tax office (depending on your current commune of residence) should issue the card automatically within 30 working days of your affiliation to the Luxembourg social security administration by your employer.

If you have a multi-annual withholding tax card, you will not receive a new card at the beginning of the following year unless you submit any changes to your status or personal data. Changes in civil status or address will trigger the automatic establishment of a new tax card for resident taxpayers without requiring their intervention or request.

Where the tax card is delivered

The tax cards are normally sent to the holders by post, using the address of registration. It is not possible to collect the tax cards directly at the RTS tax offices!

However, you can use the eDelivery feature to receive the document in electronic format in your private eSpace on MyGuichet.lu. To benefit from this service, you will need to subscribe to the eDelivery feature for official documents to be sent to your private eSpace. You can do it by clicking «My data» in the «Taxation» section of the page, and then «Subscription to ACD documents».

For more detailed explanations of how to work with eSpace services, you can use the downloadable tutorial from Guichet. There you can find the step-by-step instruction provided in English in the format of a presentation.

Tax cards for special cases

There are specific rules, that apply to the cases of joint taxation for married couples and people, who officially work multiple jobs in the Grand Duchy.

Married people

People with multiple jobs

Both in the case of spouses who have opted for joint taxation and in the case of individuals with several jobs, the withholding rate for the main tax card is calculated based on the highest salary. And all other tax cards are considered «secondary» tax cards and apply a fixed tax withholding rate of:

Because of this system, many taxpayers may end up owing taxes at the end of the year, as the taxes withheld throughout the year may not be enough to cover the amount.

How to register a tax deduction on the tax card

Adding a tax deduction to your Luxembourg tax card can be beneficial as it can reduce the amount of taxes that are withheld from your salary or pension income. Additionally, it can help ensure that you do not overpay taxes throughout the year and will potentially receive a tax refund when you file your tax return.

To register certain tax deductions on your tax card, you can make a request to the relevant tax office using the same form 164 R. There are numerous deductions, that can be mentioned on your tax card, according to what is available for you:

- Additional professional expenses;

- Single-parent tax credit;

- Debtor interest – only concerning consumer loans counted as special expenses;

- Divorce-related arrears on payments and permanent expenses;

- Certain extraordinary expenses: illness, dependant parents, disability, domestic staff expenses, childcare expenses, etc.

- Flat rate travel expenses;

- The deduction of the increased allowance for business expenses of disabled employees.

Remember that the registration of a tax deduction on the tax card is only valid for the year for which it is requested. Requests must be renewed each year to verify if the required conditions are met.

How to modify the information on a tax card

If you receive your Luxembourg tax card and notice any errors in the information provided, you should immediately request a correction from the competent authority that issued the tax card using:

- form 164 R for residents,

- form 164 NR for non-residents.

It is strictly prohibited for both the employee and employer to make any changes to the information on the tax card themselves, keep this in mind.

If there are any significant changes to your civil status, family situation, or employer change, that affect your tax class, the tax card will be automatically updated by the RTS office for residents or by request to the RTS Non-Residents office for non-residents.

If you get married or become a parent during the fiscal year, you may be eligible for a change in tax class and can request a tax deduction for the child. These changes take effect from the date of marriage or treatment of the individualization request or the birth of the child. The updated tax card will be made available to your employer or pension fund, and the tax withheld will be adjusted accordingly.

If you want to learn more about the Luxembourg tax system, you can check our series of articles about this subject. We already covered tax residency, the type of taxes in Luxembourg, the tax classes, and much more:

What taxes are paid in Luxembourg

Frequently Asked Questions (FAQ)

What is a Luxembourg tax card, and who needs one

How is the amount of tax withheld from my paycheck determined

What do you need to do to get a tax card

Can I make changes to my tax card after it has been issued

What should I do with my tax card, if my circumstances change during the year

Source: guichet.public.lu, analietax.com

We took photos from these sources: Kelly Sikkema for Unsplash, Illustration by Luxtoday, document sample from Administration des contributions directes