Mortgage in Luxembourg: requirements, rates and guide to obtaining a loan

If you're considering purchasing property in Luxembourg, navigating the realm of mortgages is a crucial step in making your homeownership dreams a reality.

Understanding the intricacies of mortgage loans, rates, requirements, and other essential details is paramount to securing favorable terms and avoiding unforeseen surprises. In this comprehensive guide, we'll take an in-depth look at the different types of mortgages and their rates, demystify the inner workings of mortgages in Luxembourg, provide a step-by-step process for obtaining a mortgage in this dynamic market, and shed light on the factors that can influence mortgage approval.

Mortgage types and available rates in the Grand Duchy of Luxembourg

To start, we'll explore the variety of mortgage types available and how they match different individual needs. We'll also analyze the current mortgage rates in Luxembourg, shedding light on the existing market conditions. By comparing current rates with historical data, our goal is to give you a thorough understanding that helps you make informed decisions.

Types of mortgages

In Luxembourg, the diverse range of mortgage options caters to various preferences and financial strategies. We can categorize mortgages based on the type of rate or the amortization method.

What is amortization?

In simpler terms, amortization is how a mortgage loan's balance decreases over time. In the early years of a mortgage, payments are primarily interest; as time goes on, more of each payment is applied to the principal balance. This schedule ensures that the loan is fully paid off by the end of its term.

In Luxembourg, the most prevalent mortgage type is the amortizable mortgage, where monthly payments are divided into two parts: a portion of the borrowed capital and the loan interest. On the other hand, non-amortizable mortgages function differently. In these, the monthly payments cover only the loan interest, and the repayment of the borrowed capital is deferred until the final installment.

Understanding these mortgage types empowers you to align your choice with your financial goals and risk tolerance. There are several types of rates available for mortgages in Luxembourg.

Fixed-Rate Mortgage

Variable-Rate Mortgages

Adjustable-Rate Mortgage

Mixed-Rate Mortgage

Mortgage rates

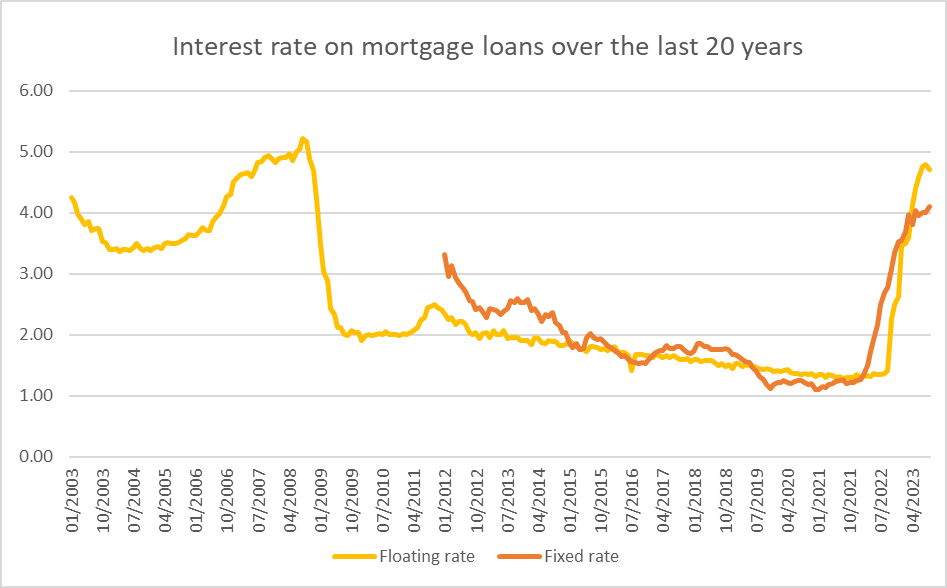

In Luxembourg, mortgage interest rates remained notably low from early 2009 until late 2021. Variable rates, averaging 2.38% in 2009, steadily declined to 1.31% in 2021. Similarly, fixed rates followed a comparable trend, decreasing from 2.75% in 2012 to 1.20% in 2021. However, over the last two years, there has been a significant upswing.

In 2022 and especially in 2023, both variable and fixed rates experienced substantial increases, reaching 4.71% for variable rates and 4.10% for fixed rates in September 2023.

The Banque Centrale du Luxembourg (BCL) publishes the latest mortgage rates monthly. To stay informed about market dynamics and track the evolution of interest rates in Luxembourg, we recommend regular visits to their website. Keeping a close eye on these trends will empower you to make informed decisions in the ever-evolving landscape of mortgage interest rates in Luxembourg.

Step-by-step guide to obtaining a mortgage in Luxembourg

A mortgage is a financial arrangement granted by an institution to facilitate the purchase of real estate. Key to understanding this process is the borrower's authorization for the bank to sell the property in the event of missed loan repayments.

Crucially, Luxembourg's legislation strictly regulates this practice. Despite authorizing the bank to sell the property if payments are not made, your home remains your property. The bank does not possess the right to enter without permission, dictate occupancy, or collect rent.

How it works?

While offering your home as collateral is a crucial aspect, it alone may not secure the loan. The bank assesses your financial situation, considering criteria such as monthly income, personal, familial, and professional circumstances, before approving your real estate project.

How to apply for mortgage in Luxembourg?

Now that we have a clearer understanding of how mortgages work in Luxembourg, let's jump into a step-by-step guide to getting one and navigate the intricacies of mortgages in Luxembourg with confidence.

For existing homeowners purchasing another property, an initial deposit is typically required. An intriguing alternative, especially if aiming for a 100% borrowed amount, is to consider a personal loan for the mortgage down payment. If you are interested in this option, we recommend that you take a look at our article dedicated to this topic.

Read the article

The initial step in the mortgage application process involves estimating how much you can borrow, a calculation primarily based on your income. Generally, mortgage payments shouldn't exceed 35% of income, though some banks may allow up to 45%. Some banks offer a mortgage capacity calculator to help you with this task.

The Commission de Surveillance du Secteur Financier (CSSF) further regulates borrowing percentages based on your homeowner status:

- First-time buyers are eligible to borrow up to 100% of the property's value;

- Non-first-time buyers can borrow up to 90%, necessitating a minimum 10% deposit. Some flexibility exists, with lenders offering higher borrowing levels on 15% of mortgages;

- Buy-to-let investors can borrow up to 80%, requiring a 20% deposit.

The next crucial step in securing a mortgage is finding the best rates, and you have two primary options. The first involves conducting your own search across various financial institutions making a mortgage comparison. Alternatively, you can enlist the services of a mortgage broker.

Personal research with mortgage calculators

Banks and credit institutions typically offer mortgage payment calculators, allowing you to customize loan parameters such as amount and duration. This tool provides an initial insight into loan costs, helping you eliminate excessively expensive options.

Once you identify entities with reasonable rates, perform a comprehensive loan simulation tailored to your financial reality. Understand specific requirements and necessary documents by each bank. The simulation process involves filling out a form with questions about the loan and personal information, accessible through a link next to the calculators.

Notable financial institutions in Luxembourg include BGL, BIL, and Spuerkeess.

Banking account for a loan

Most likely you already have a bank account, however, some banks require your main income such as your salary to be directly deposited in their bank as a condition for granting you the loan. So you should open an account with them.

Mortgage brokers services

While less common in Luxembourg than in other countries, mortgage brokers can secure more advantageous interest rates by exploring both major banks and smaller credit entities.

Now you are probably wondering: should I use a mortgage broker? Generally, it's a good idea. Their expertise can be invaluable, especially if you're unfamiliar with the Luxembourgish mortgage system. Importantly, they are typically remunerated by credit institutions, so their services often come at no cost to you.

The subsequent step in the mortgage application process is gathering the necessary documents. Typically, you'll need:

- Passport or ID card;

- Proof of residence, such as recent gas or electricity bill;

- Income proof. For employees, photocopies of the last three pay stubs; for self-employed and pensioners, a photocopy of the last tax assessment.

- Amortization schedules for existing loans, if you have them. This aids the bank in assessing your debt-to-income ratio.

- Land Registry information, overall property price, and price per square meter you plan to pay.

- While not always required, some banks may request authorization to claim against your employment income if mortgage repayments are missed.

- Specific document requirements may vary among institutions, and these details are typically communicated during the full simulation process.

Ensuring you have these documents ready streamlines the mortgage application, expediting the approval process. Stay organized and prepared as you move closer to securing your mortgage in Luxembourg.

The final step involves submitting your application along with all necessary documents and, once approved, signing all required paperwork.

Some banks offer convenient online application forms, while you can also visit the bank in person, consult with an advisor, and directly submit all required documents. Alternatively, if you've engaged the services of a mortgage broker, they handle the entire process, guiding you through and requesting the necessary documents.

Do you need to be in Luxembourg to get a mortgage loan?

In either scenario, after loan approval, a visit to the bank is necessary to sign all the essential documents formalizing the mortgage. This marks the culmination of the application process.

Frequently Asked Questions (FAQ)

How do mortgage interest rates in Luxembourg compare historically?

Mortgage interest rates in Luxembourg remained notably low from 2009 to 2021. However, recent years have seen a substantial increase. For up-to-date information, individuals can refer to the monthly publications by the Banque Centrale du Luxembourg.

What factors influence mortgage approval in Luxembourg?

Several factors affect mortgage approval, including monthly income, personal, familial, and professional situations. The Commission de Surveillance du Secteur Financier (CSSF) regulates borrowing percentages based on homeowner status.

Should I use a mortgage broker services to find the best rates?

While less common in Luxembourg, mortgage brokers can secure more advantageous rates by exploring various lenders. They are often remunerated by credit institutions, making their services potentially cost-free for borrowers.

How can I estimate how much I can borrow for a mortgage in Luxembourg?

Use mortgage payment calculators offered by banks, considering your income. Generally, mortgage payments shouldn't exceed 35% of income, though some banks may allow up to 45%. The CSSF also imposes limits based on homeowner status, allowing first-time buyers to borrow up to 100%, while buy-to-let investors can borrow up to 80%.

Source: www.expatica.com, blog.vivi.lu, www.bcl.lu, www.bgl.lu, www.bil.com, www.spuerkeess.lu

We took photos from these sources: Photo by Jessica Bryant for Pexels